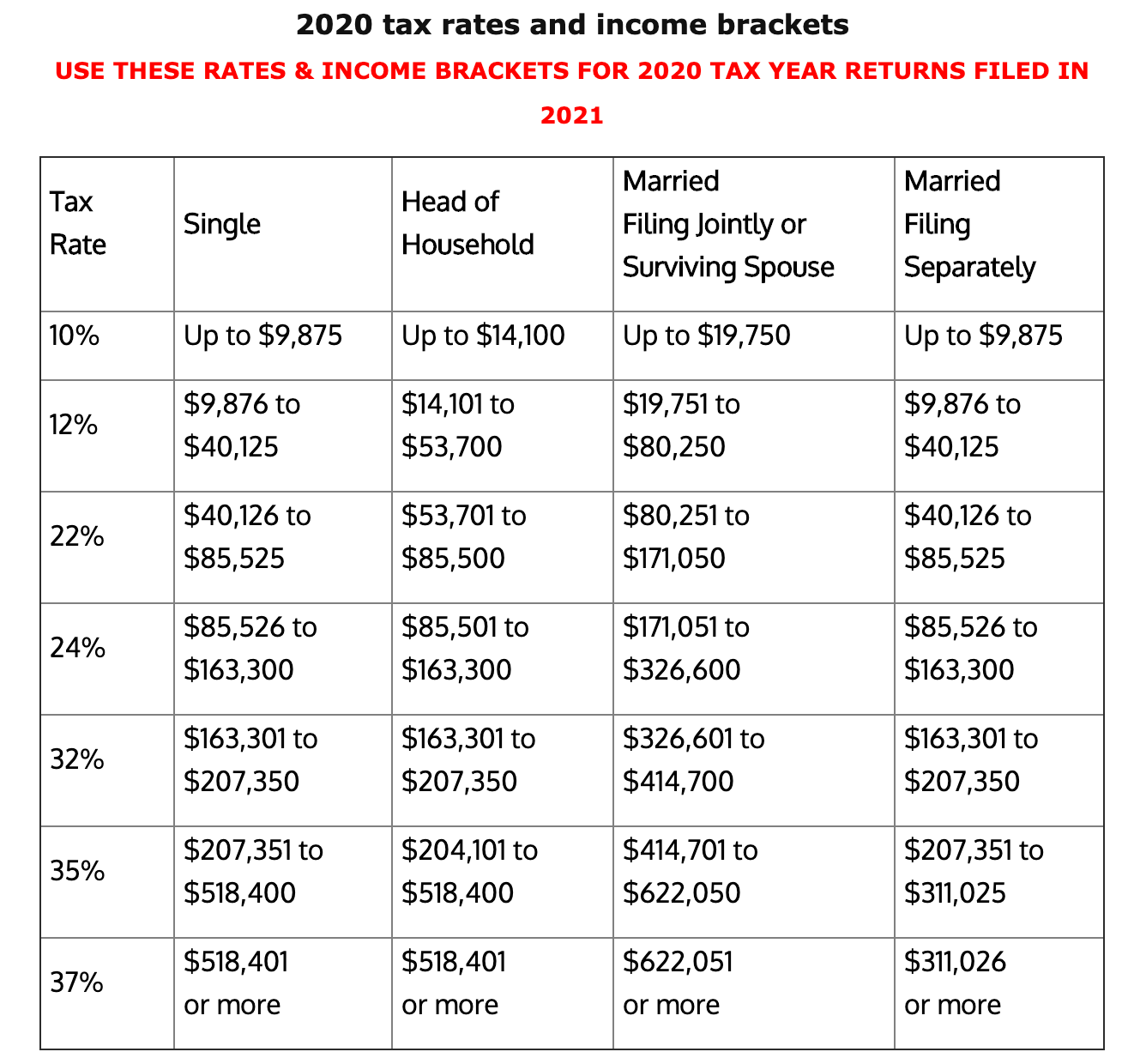

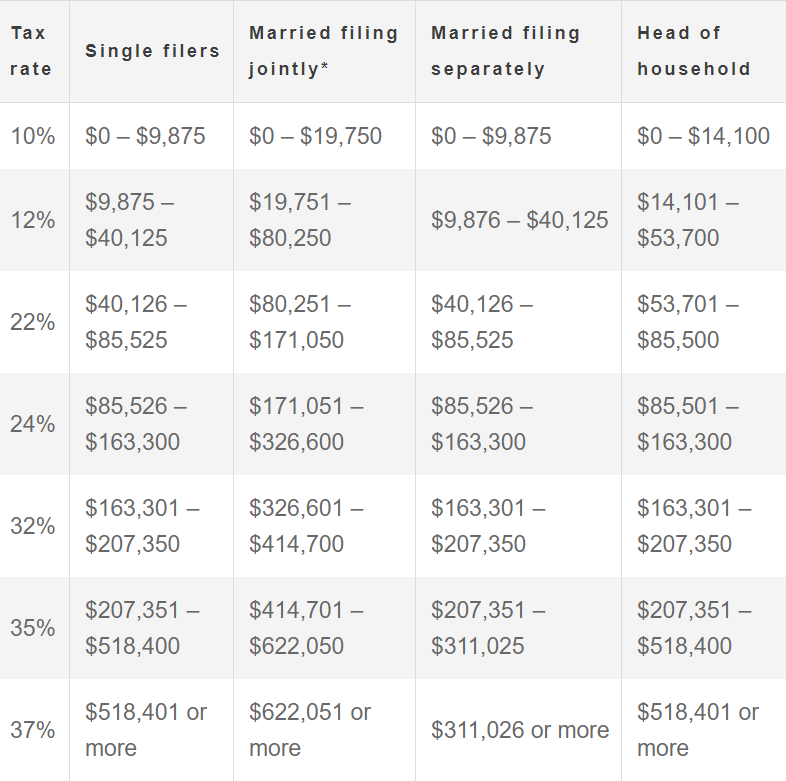

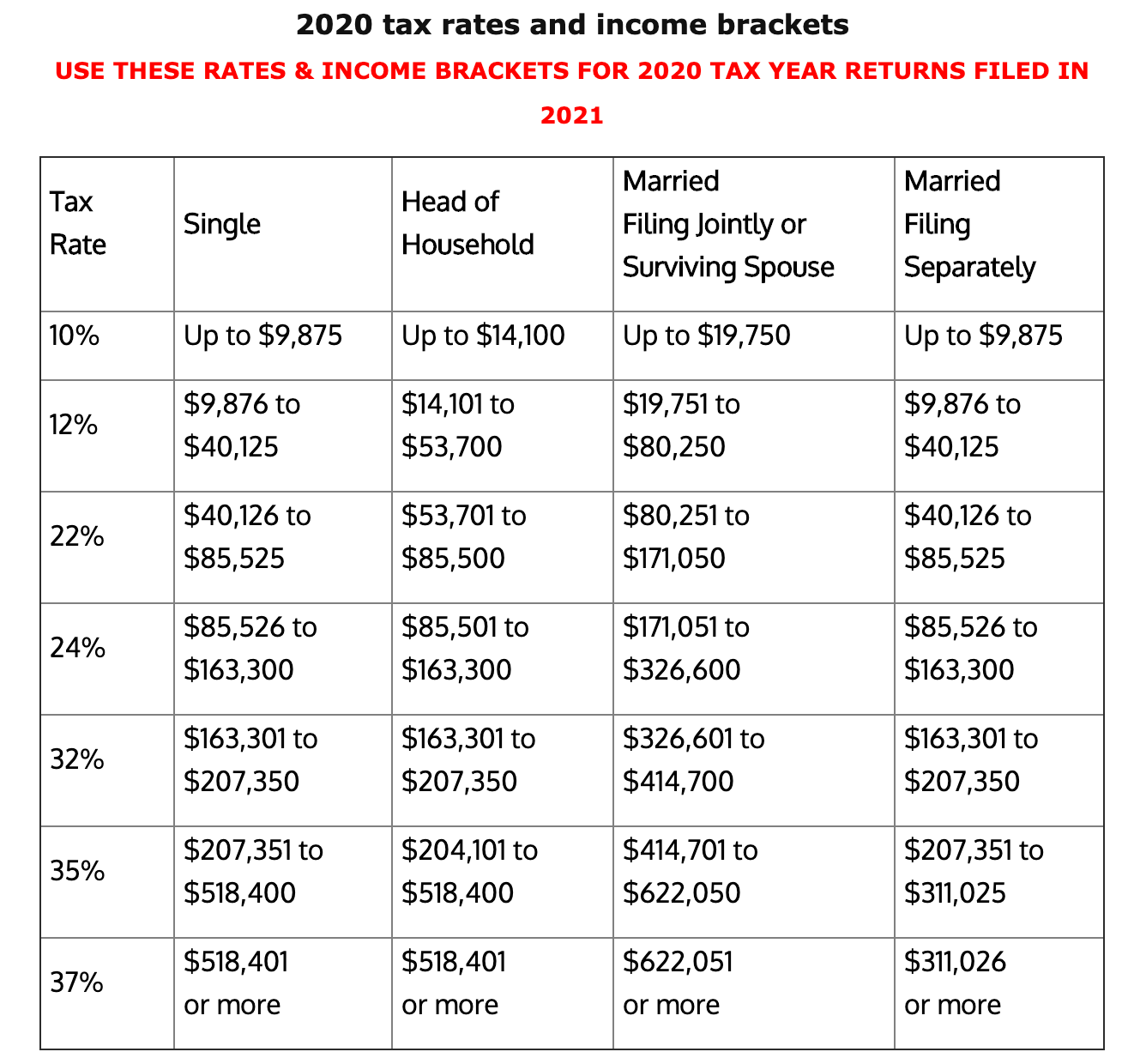

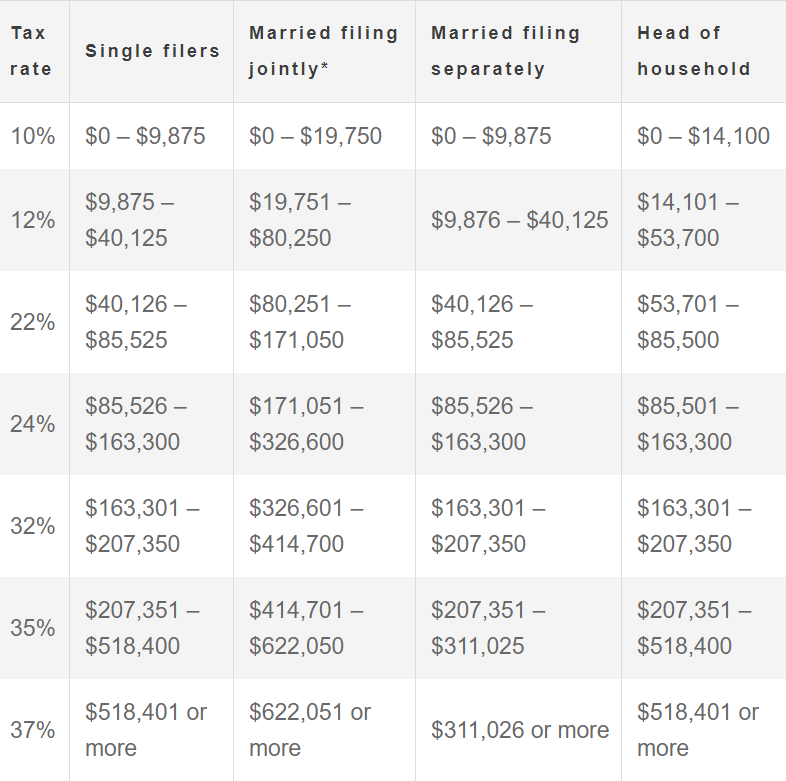

A VCOC is considered Ohio based when more than 50% of their full-time equivalent employees are residents of Ohio. Provides a capital gain deduction for all or a portion of capital gains received by investors on the sale of their equity interests (does not appear to apply to asset sales) in certain Ohio based "venture capital operating companies" (VCOCs) that are certified by the Director of Development. The deduction should be calculated by an owner on an entity-by-entity basis.Ģ.) Venture Capital Investments. The capital gain deduction is equal to the lesser of the owner’s capital gain or 50% of the business' qualifying payroll after applying the taxpayer's ownership percentage. Income Tax Deductions on Qualifying Capital GainsĪlthough not effective until tax years beginning on or after Januthere are will be two capital gain changes for business taxpayers.ġ.) Capital Gains from the Sale of a Business - Permits a capital gain deduction for taxpayers who materially participated (not defined yet) in a business that was headquartered in Ohio for the five (5) preceding years or made a venture capital investment of at least $1 million in a qualifying business. Permits a nonrefundable income tax credit on private school tuition - $500/$1,000 credit for families with Federal Adjusted Gross Income (FAGI) less than $50,000/$100,000. Allows up to a $750 annual credit on charitable contributions made to a nonprofit scholarship granting organization (SGO) for low-income primary and secondary school students (Once certified the Ohio Department of Taxation will post a list of qualifying SGOs). Allows a credit up to $250 on purchases of supplies by homeschoolers. Conforms Ohio to federal railroad retirement benefit exemption. Increases the Opportunity Zone Investment Credit available to an individual from $1 million to $2 million. Ohio’s new budget includes several new deductions and credits: Personal Income Tax Bracket and Rate Comparison Between 2020/2021 While most brackets include a 3% rate reduction, the largest reduction applies to taxpayers earning more than $110,650 with a reduction in the tax rate from 4.797% to 3.99%. Also, for tax years beginning in 2021 Ohio income tax is completely eliminated for those individuals earning $25,000 or less. The Ohio Regional Income Tax Agency has posted on its website that it will allow refunds to be filed for 2020, but will not process until the various court cases are decided, which may take many months.Īs has been included in several of the past budget bills, Ohio will reduce the number of tax brackets from six to five and apply lower tax rates to each of the new brackets. However, refunds for 2020 will depend on the outcome of several court cases filed in Ohio and nationally, it will likely take many months before we know the outcome. 110 will allow employees to file refund claims with their principal place of work municipality for days that they did not work within the withholding city during 2021 only. 197, many employees were adversely impacted when they changed their COVID work locations to a lower or no tax municipalities.

A VCOC is considered Ohio based when more than 50% of their full-time equivalent employees are residents of Ohio. Provides a capital gain deduction for all or a portion of capital gains received by investors on the sale of their equity interests (does not appear to apply to asset sales) in certain Ohio based "venture capital operating companies" (VCOCs) that are certified by the Director of Development. The deduction should be calculated by an owner on an entity-by-entity basis.Ģ.) Venture Capital Investments. The capital gain deduction is equal to the lesser of the owner’s capital gain or 50% of the business' qualifying payroll after applying the taxpayer's ownership percentage. Income Tax Deductions on Qualifying Capital GainsĪlthough not effective until tax years beginning on or after Januthere are will be two capital gain changes for business taxpayers.ġ.) Capital Gains from the Sale of a Business - Permits a capital gain deduction for taxpayers who materially participated (not defined yet) in a business that was headquartered in Ohio for the five (5) preceding years or made a venture capital investment of at least $1 million in a qualifying business. Permits a nonrefundable income tax credit on private school tuition - $500/$1,000 credit for families with Federal Adjusted Gross Income (FAGI) less than $50,000/$100,000. Allows up to a $750 annual credit on charitable contributions made to a nonprofit scholarship granting organization (SGO) for low-income primary and secondary school students (Once certified the Ohio Department of Taxation will post a list of qualifying SGOs). Allows a credit up to $250 on purchases of supplies by homeschoolers. Conforms Ohio to federal railroad retirement benefit exemption. Increases the Opportunity Zone Investment Credit available to an individual from $1 million to $2 million. Ohio’s new budget includes several new deductions and credits: Personal Income Tax Bracket and Rate Comparison Between 2020/2021 While most brackets include a 3% rate reduction, the largest reduction applies to taxpayers earning more than $110,650 with a reduction in the tax rate from 4.797% to 3.99%. Also, for tax years beginning in 2021 Ohio income tax is completely eliminated for those individuals earning $25,000 or less. The Ohio Regional Income Tax Agency has posted on its website that it will allow refunds to be filed for 2020, but will not process until the various court cases are decided, which may take many months.Īs has been included in several of the past budget bills, Ohio will reduce the number of tax brackets from six to five and apply lower tax rates to each of the new brackets. However, refunds for 2020 will depend on the outcome of several court cases filed in Ohio and nationally, it will likely take many months before we know the outcome. 110 will allow employees to file refund claims with their principal place of work municipality for days that they did not work within the withholding city during 2021 only. 197, many employees were adversely impacted when they changed their COVID work locations to a lower or no tax municipalities.

Effective January 1, 2022, employers will be required to return to the pre-COVID 20-day rule.Īlthough many employers benefited from COVID withholding provisions under H.B. 197 withholding procedures through December 31, 2021.

110 allows, but does not require, employers to extend the H.B. However, in order to assist employers as they evaluate their post-COVID return to work policies and procedures, H.B. 197, which required employers to continue to withhold local municipal income taxes based on an employee’s principal place of work, expired 30 days after on July 18, 2021. Streamlined many tax incentive programs and extended or created several new tax incentive programs for taxpayers retaining or creating jobs in OhioĪs most Ohio taxpayers are aware, Ohio’s emergency order ended Jand with that the withholding changes under H.B.Allowed Commercial Activity Tax exclusions of BWC Dividend Refunds to become permanent.Eliminates the sales tax on employment labor services and employment placement services.Reduces the top personal income tax rate from 4.797% to 3.99% for tax years beginning on or after January 1, 2021.Provides municipal income tax withholding guidance to employers and remote workers and addresses 20 municipal income tax refunds from principal place of work municipalities.110) into law after vetoing 14 different provisions in the bill. On Thursday, July 1, 2021, Governor Mike DeWine signed House Bill 110 (H.B.

0 kommentar(er)

0 kommentar(er)